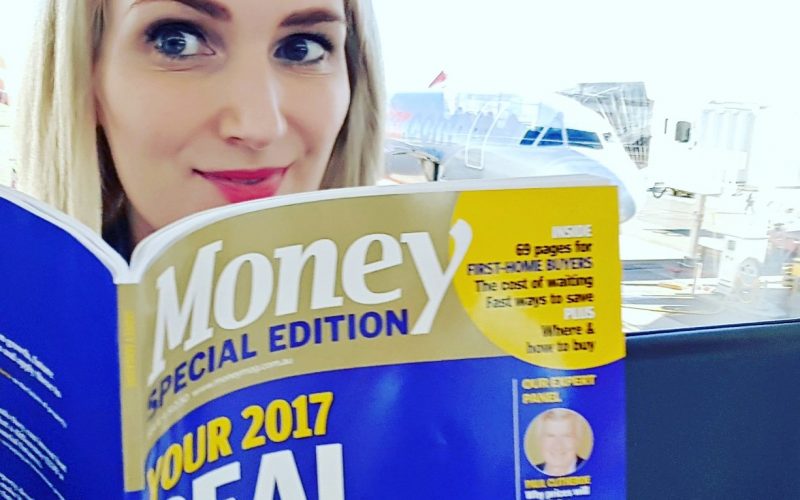

This will be the first of a series of posts where I interview people from a diverse range of backgrounds about their financial habits and goals. I’m bloody excited to have Bronwyn from Miss Money Box as my first guest! She started Miss Money Box to help Australian women expand their general knowledge around personal finance. Go girl! 😉

I love reading her stuff because she makes concepts like investing super easy to understand. I got some useful tips on how to get started in investing from her blog.

She’s really passionate about helping Australian women learn more about personal finance. Hence, she’s undertaking a Master of Research in the discipline of Economics, Finance and Marketing at the Royal Melbourne Institute of Technology (RMIT). Her thesis is exploring the barriers women face in engaging with the investment services industry.

Who or where did you learn your money habits from?

I learned my money habits from both my parents, but the stock market (which I love) became part of my life when my dad introduced me to it in my early teens.

My dad would call me in the evening from work and get me to relay the high, low and closing prices of all the stocks in his portfolio from the newspaper. I didn’t know much about what dad was doing but it piqued an interest that has formed the basis of my entire financial life strategy.

Dad’s enthusiasm for the stock market powered on long into his retirement, and mine has only grown since my teenage years. In my 20s, I started buying shares. I wasn’t sure where I wanted to end up so buying a place (and being able to afford to buy a place!) was not the right option for me.

Are you happy with your current financial situation? Is there anything you would like to change?

I am pretty happy with my current financial situation as I’ve been saving and investing for the last 10 years. Along the way, I’ve had some great success with the stock market as well as some big failures.

When I started investing, I didn’t know about Exchange Traded Funds – probably because they didn’t really exist – so I would love to have more of those, rather than individual shares which are more volatile.

What is the best financial advice you have received?

From a young age, my parents instilled in me the idea that it is my responsibility to take care of my finances. No one else is going to pay my bills for me! Because of this I am constantly educating myself and take an interest in my day-to-day finances. I’m always keen to acquire assets (like shares) that make my money work for me.

Is there any financial advice that you would like to receive? Or any topics that you would like to learn more about?

While I feel I should learn more about insurance, I struggle with it a bit. So, while I *should* learn more about insurance, I’m slightly lacking in motivation to try. I’ll get there one day, I hope.

If you were given $1 million AUD, what would you do with it?

If I was given $1 million what I’d really like to do would be to buy an apartment or a house. There’s something to be said for the sense of security that would provide. If there was anything left over I’d put it in an index fund and also indulge my love of history by going to Scotland to trace my family tree.

If you’re interested in getting involved or know someone that I should interview, please get in touch!

1 comment

Thanks for the interview Rachel. Always happy to meet another lady who’s taking control of her personal finances… and blogging about it!

Comments are closed.